Wanna Learn How I Budget my Finances?

While the

subject of budget may sound battling with your own self, learning how to do it at

an early age may be beneficial once you start earning your own money. Since we

were young, we were being taught on how to save money. Though, it may sound so

easy to say, doing it is really hard, especially if there are too many temptations

around – new clothes, new shoes, new gadgets, etc. – well, at least for me.

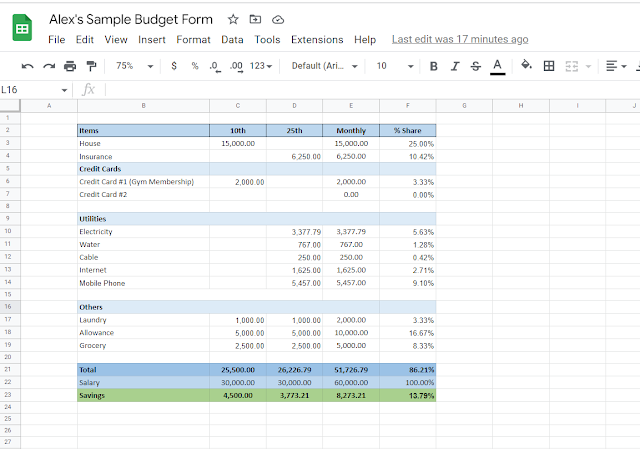

In this

article let me share to you how I do my own budget on a bi-monthly and monthly

level. Ill share here a sample Excel sheet where you’d see how I categorized

each expense that I have to deal with every pay day, as well as the amount of

saving I have. I hope that at the end of this article, you’ll be able to learn

a thing or two on budgeting, which would help you in the coming days.

Lastly, for the Savings part – ideally, professionals will say to us to have at least 30% of our monthly income go to our savings, another 30% to our emergency fund and the remaining for our daily expenses. Though, I must admit that my salary is not the enough, I think I’m doing a good job trying for both ends meet. With a house amortization and insurance, which serve as my investment as well, I’m somehow finding comfort in life now. Also, with almost 14% saving every month, I’m finding some leg room on my daily routine, without worrying too much. I just hope that I’ll get to earn more so that I can splurge on more fun part of this life. Hello, boss, I hope you’ll get to ready this. Haha! You can find the online version of this excel file here.

.png)

Post a Comment